HOUSTON – The rock-bottom mortgage rates that propped up the housing market during the downturn will hold it back in the years ahead, real estate economists say.

Mortgage rates will inevitably increase as the economy continues to recover and the Federal Reserve winds down a stimulus program that has kept rates artificially low, according to several economists who spoke on a panel on the future of the housing market at the National Association of Real Estate Editors’ (NAREE) spring conference.

As that shift occurs, many homeowners who might consider selling their homes to buy new homes will choose to hold onto them in order to avoid trading in mortgages with historically low rates for loans with steeper ones, they said.

Almost half of all U.S. mortgages have rates of 4.5 percent or less — levels that buyers won’t enjoy in the future, according to Mark Fleming, chief economist at data aggregator CoreLogic.

“There’s a huge disincentive to … refinance, and also to sell at any point in the future,” Fleming said. “That’s bad news for real estate agents; that’s bad news for mortgage lenders” and “for anybody who participates in the turnover of housing.”

Zillow Chief Economist Stan Humphries added, “As mortgage rates get higher over the next few years, this is going to have a chilling impact on existing-home sales.”

For more than four decades, Humphries said, mortgage rates decreased by an average of 4 percent every five years, consistently serving as a tailwind to home sales. In the last five years, they’ve dropped by about 10 percent.

“That was a huge boost to existing-home sales,” he told Inman News.

But what has been a steady tailwind to the housing market for more than a generation is about to become a headwind, according to Humphries.

If mortgage rates rise to 5 percent next year, the lock-in effect on buyers would push down home sales by 3 percent if all other forces affecting the market were held equal, Humphries said. And if they rise to 6 percent, the lock-in effect would drive sales down by 11 percent, according to the economist.

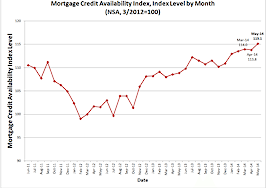

Source: Zillow

“There’s no free lunch,” Humphries said. “Payback is hell.”

Lawrence Yun, the National Association of Realtors’ chief economist, predicted that crisis-era mortgage rates will constrain inventory not only by keeping some homeowners in their homes, but by prompting many people who choose to move to hold onto their homes and rent them out rather than selling them.

That could lead to many “everyday folks becoming unplanned, accidental landlords in the future because they want to hold onto that 3.5 percent,” he said.